ANCOVA

ANCOVA

ANCOVA

Analysis of covariance (ANCOVA) is a general linear model which blends ANOVA and regression. ANCOVA evaluates whether population means of a dependent variable (DV) are equal across levels of a categorical independent variable (IV) often called a treatment, while statistically controlling for the effects of other continuous variables that are not of primary interest, known as covariates (CV).

ANCOVA

Determine main effect while correcting for covariate

- 1 dependent variable

- 1 or more independent variables

- 1 or more covariates

A covariate is a variable can be a confounding variable biasing your results. By adding a covariate we reduce error/residual in the model.

Assumptions

- Same as ANOVA

- Independence of the covariate and treatment effect §12.3.1.

- No difference on ANOVA with covar and independent variable

- Matching experimental groups on the covariate

- Homogeneity of regression slopes §12.3.2.

- Visual: scatterplot dep var * covar per condition

- Testing: interaction indep. var * covar

Data example

We want to test the difference in national extraversion but want to controll for openness to experience.

- Dependent variable: Extraversion

- Independent variabele: Nationality

- Dutch

- German

- Belgian

- Covariate: Openness to experience

Simulate data

# Simulate data

n = 20

k = 3

group = round(runif(n,1,k),0)

mu.covar = 8

sigma.covar = 1

covar = round(rnorm(n,mu.covar,sigma.covar),2)

# Create dummy variables

dummy.1 <- ifelse(group == 2, 1, 0)

dummy.2 <- ifelse(group == 3, 1, 0)

# Set parameters

b.0 = 15 # initial value for group 1

b.1 = 3 # difference between group 1 and 2

b.2 = 4 # difference between group 1 and 3

b.3 = 3 # Weight for covariate

# Create error

error = rnorm(n,0,1)Define the model

\({outcome} = {model} + {error}\) \({model} = {indvar} + {covariate} = {nationality} + {openness}\)

Formal model

\(b_0 + b_1 {dummy}_1 + b_2 {dummy}_2 + b_3 covar\)

# Define model

outcome = b.0 + b.1 * dummy.1 + b.2 * dummy.2 + b.3 * covar + errorDummies

The data

Group means

aggregate(outcome ~ group, data, mean) group outcome

1 1 38.67000

2 2 42.16625

3 3 43.79800Model fit no covar

What are the beta coëfficients based on the data without the covariate?

fit.group <- lm(outcome ~ factor(group), data); fit.group

Call:

lm(formula = outcome ~ factor(group), data = data)

Coefficients:

(Intercept) factor(group)2 factor(group)3

38.670 3.496 5.128 fit.group$coefficients[2:3] + fit.group$coefficients[1]factor(group)2 factor(group)3

42.16625 43.79800 \({Dutch} = 38.67 \> {German} = 42.16625 \> {Belgian} = 43.798\)

Model fit only covar

What is the weight of only the covariate?

fit.covar <- lm(outcome ~ covar, data)

fit.covar

Call:

lm(formula = outcome ~ covar, data = data)

Coefficients:

(Intercept) covar

15.667 3.185 Model fit with covar

fit <- lm(outcome ~ factor(group) + covar, data); fit

Call:

lm(formula = outcome ~ factor(group) + covar, data = data)

Coefficients:

(Intercept) factor(group)2 factor(group)3 covar

15.965 2.769 4.181 2.881 fit$coefficients[2:3] + fit$coefficients[1]factor(group)2 factor(group)3

18.73401 20.14609 \({Dutch} = 15.96 \> {German} = 18.73 \> {Belgian} = 20.14\)

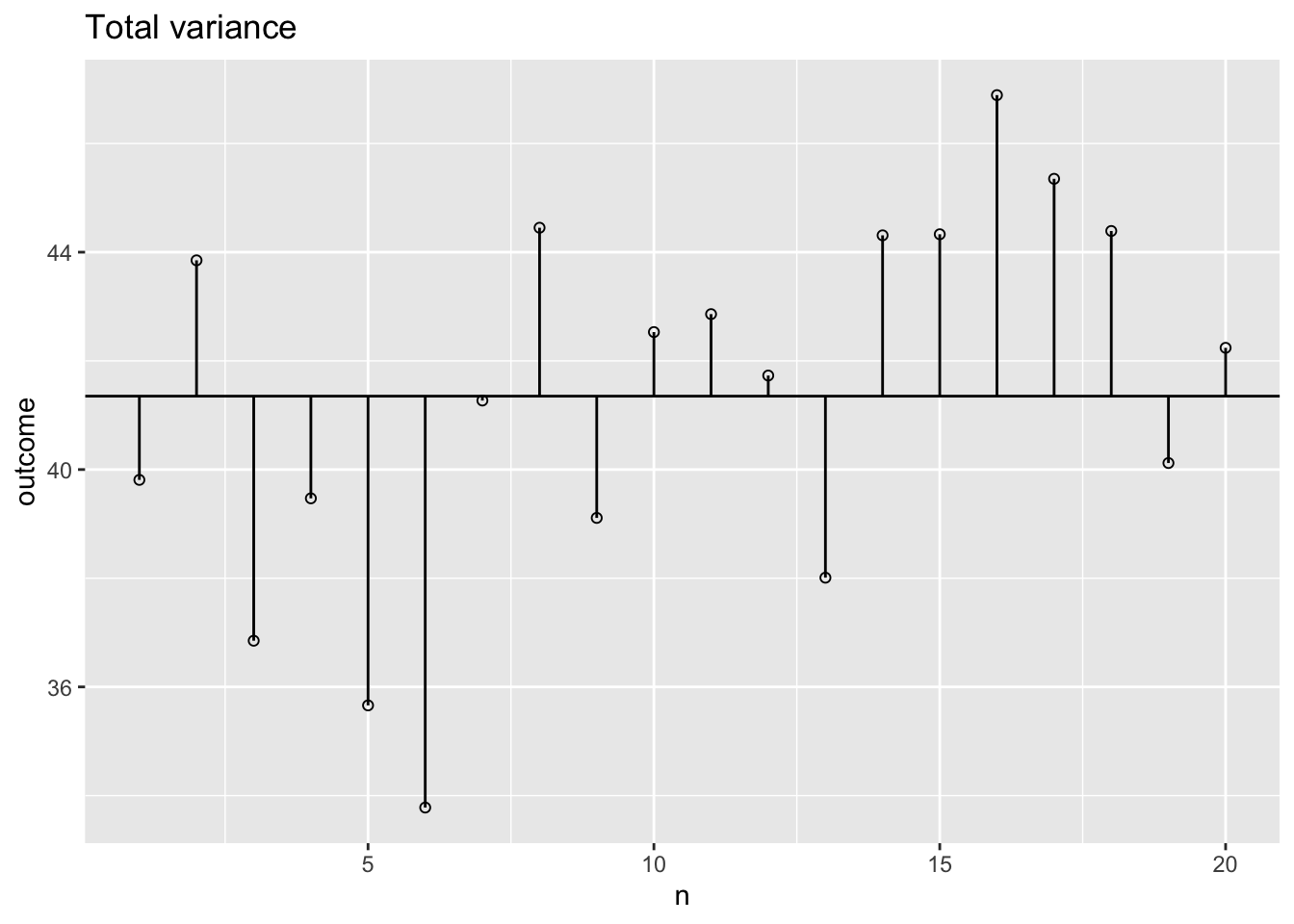

Total variance

What is the total variance

\({MS}_{total} = s^2_{outcome} = \frac{{SS}_{outcome}}{{df}_{outcome}}\)

ms.t = var(data$outcome); ms.t[1] 11.97756ss.t = var(data$outcome) * (length(data$outcome) - 1); ss.t[1] 227.5737The data

Total variance visual

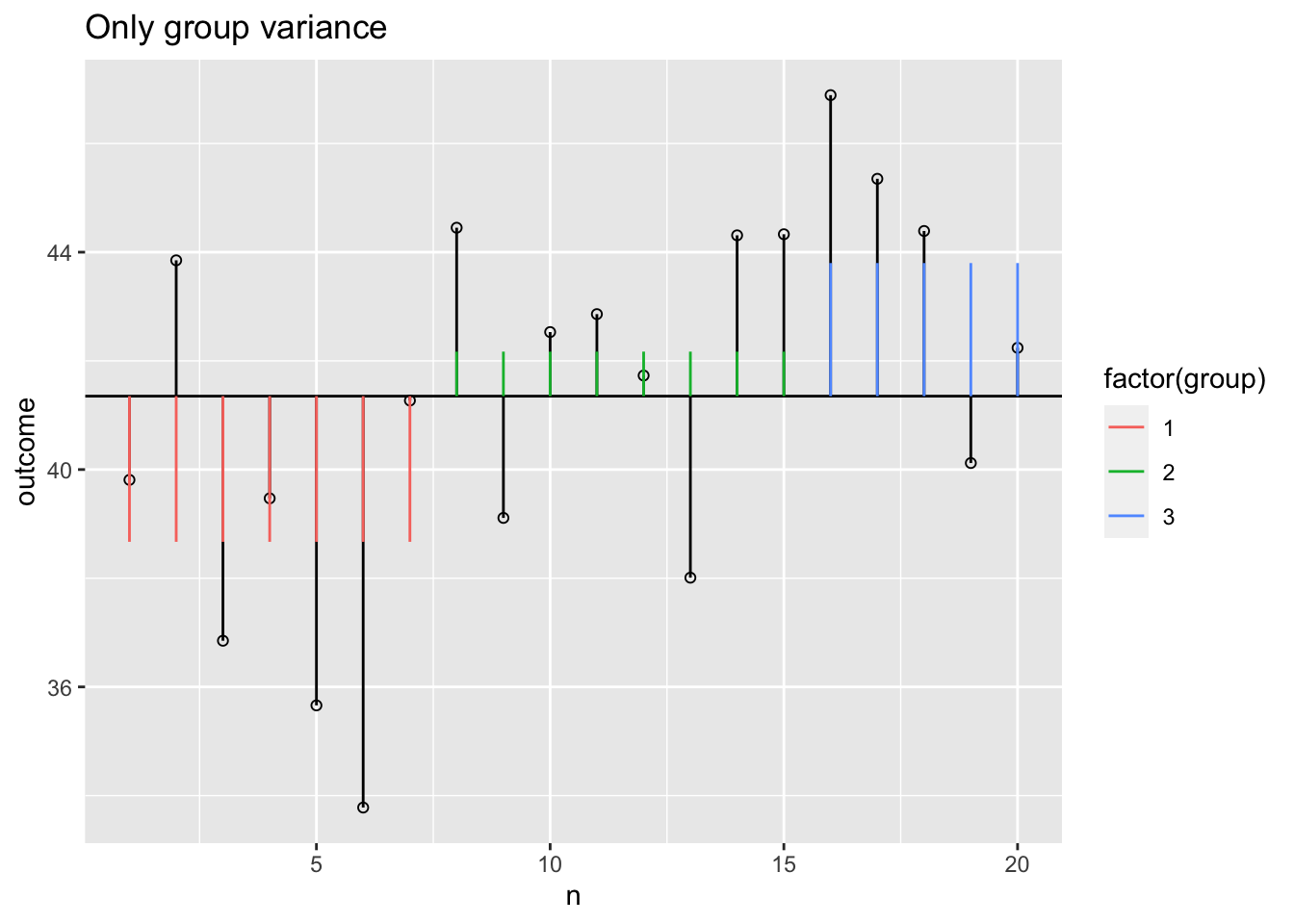

Model variance group

The model variance consists of two parts. One for the independent variable and one for the covariate. Lets first look at the independent variable.

Model variance group visual

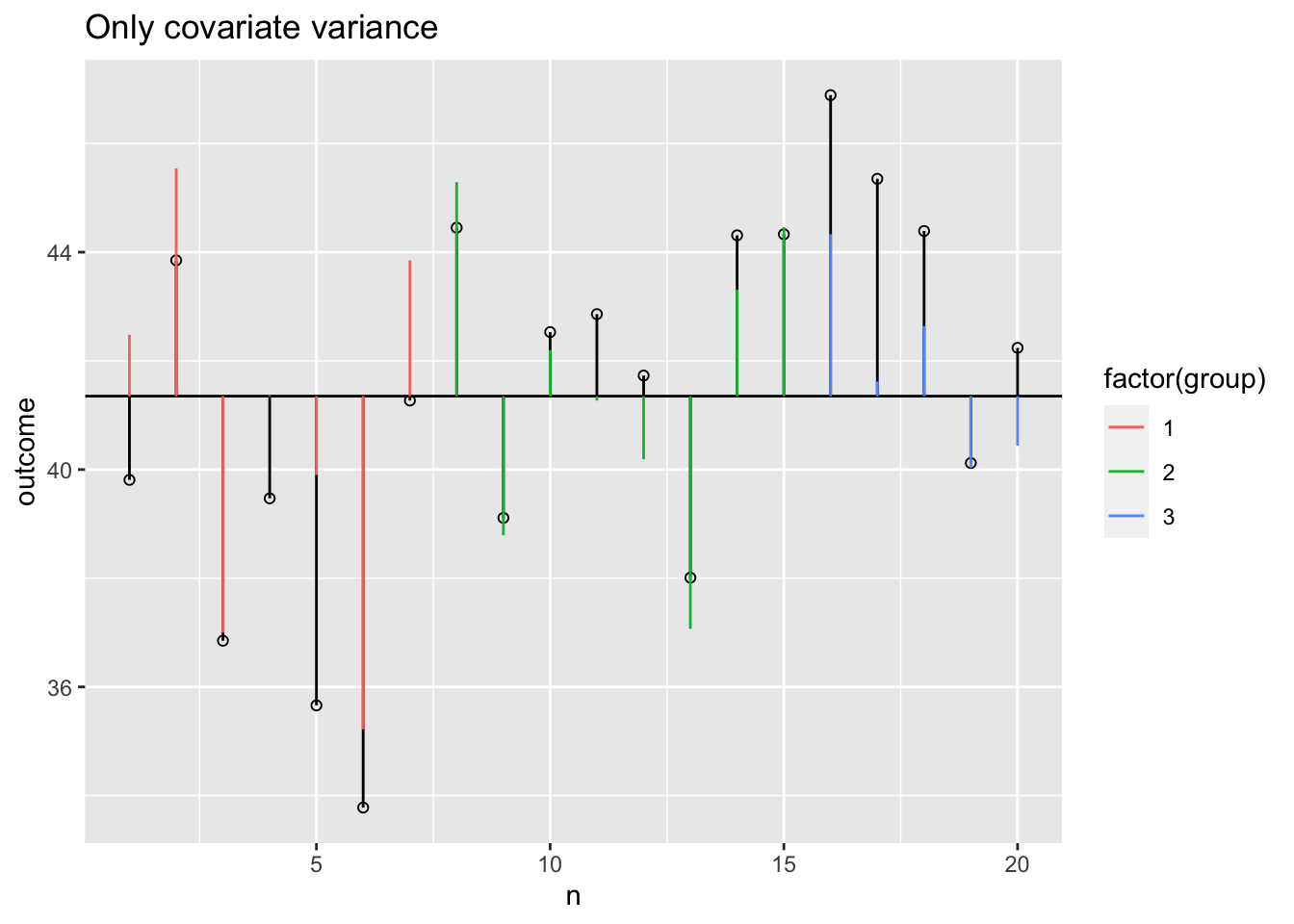

Model variance covariate visual

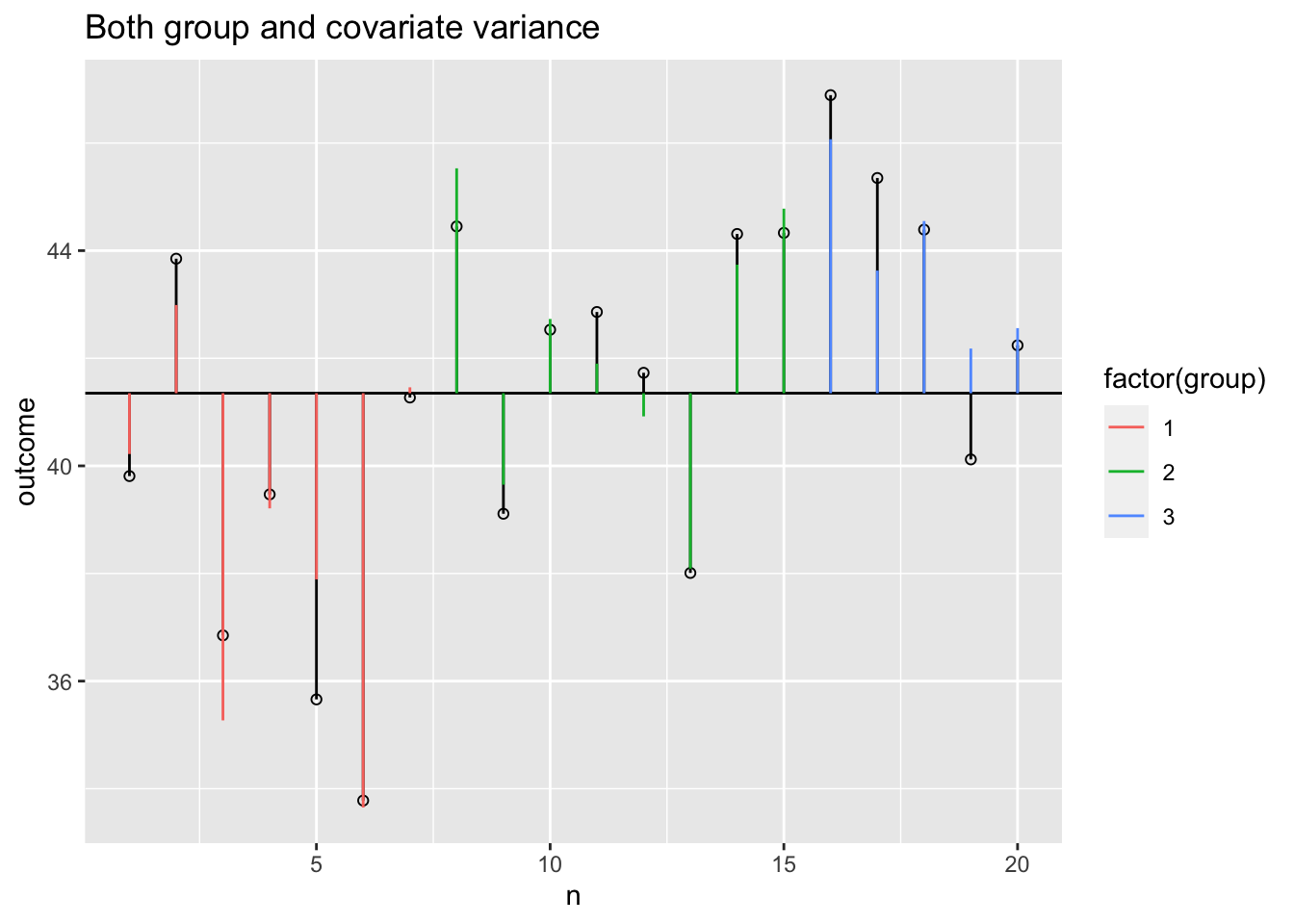

Model variance group and covariate

Model variance group and covariate visual

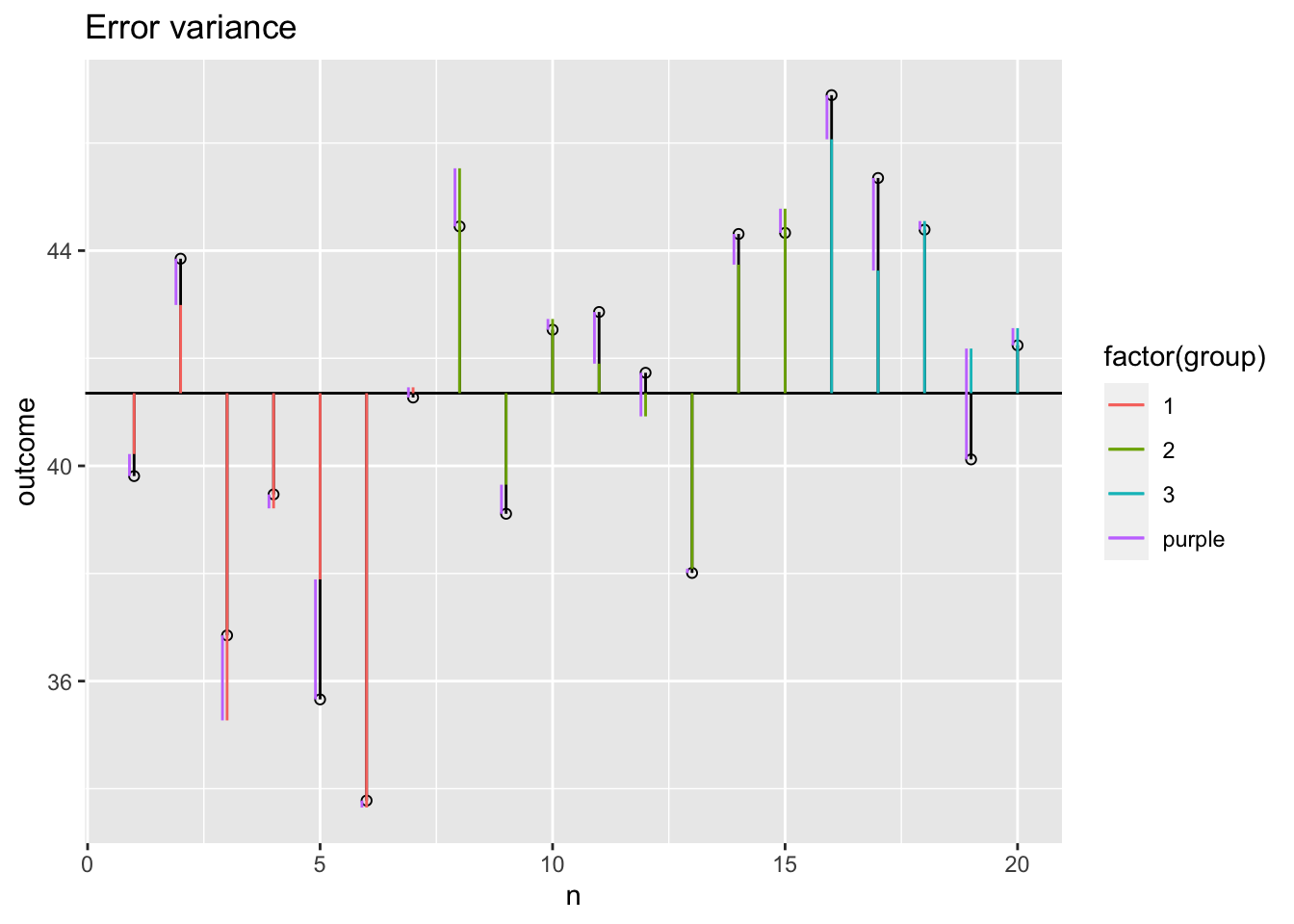

Error variance with covariate

Sums of squares

SS.model = with(data, sum((model - grand.mean)^2))

SS.error = with(data, sum((outcome - model)^2))

# Sums of squares for individual effects

SS.model.group = with(data, sum((model.group - grand.mean)^2))

SS.model.covar = with(data, sum((model.covar - grand.mean)^2))

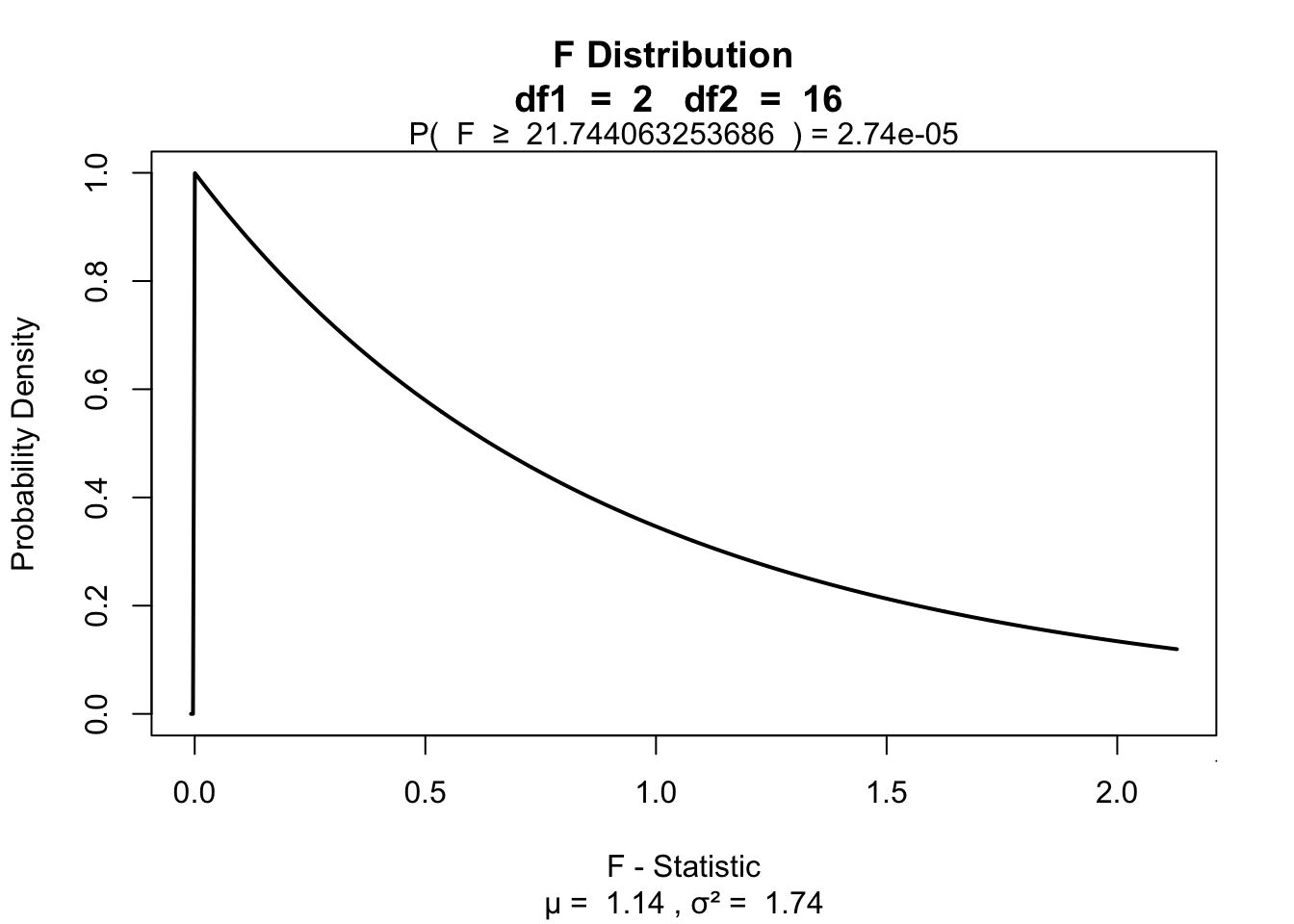

SS.covar = SS.model - SS.model.group; SS.covar ## SS.covar corrected for group[1] 121.8463SS.group = SS.model - SS.model.covar; SS.group ## SS.group corrected for covar[1] 54.65778F-ratio

\(F = \frac{{MS}_{model}}{{MS}_{error}} = \frac{{SIGNAL}}{{NOISE}}\)

n = 20

k = 3

df.model = k - 1

df.error = n - k - 1

MS.model = SS.group / df.model

MS.error = SS.error / df.error

F = MS.model / MS.error

F[1] 21.74406\(P\)-value

library("visualize")

visualize.f(F, df.model, df.error, section = "upper")

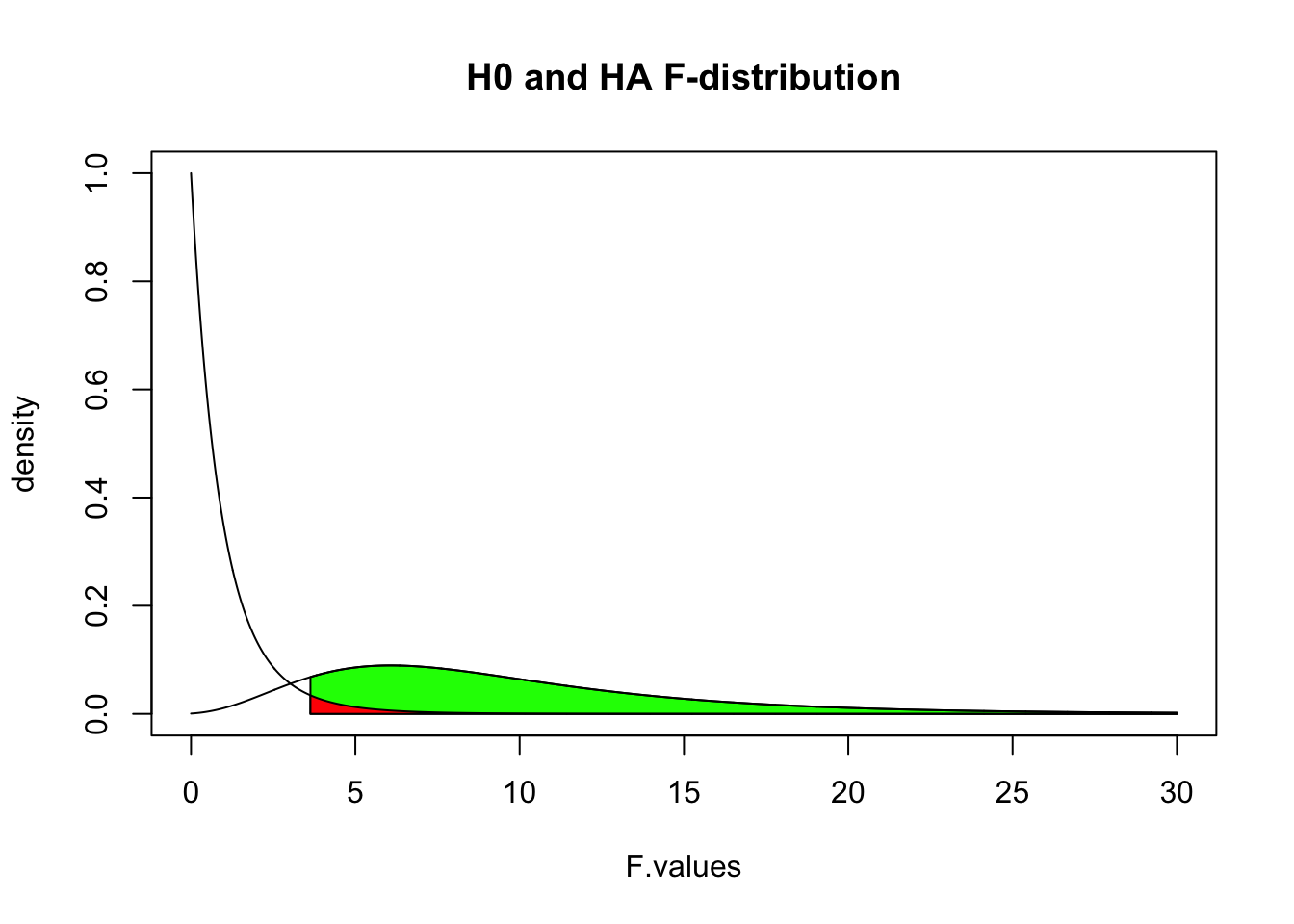

Alpha & Power

Adjusted means

# Add dummy variables

data$dummy.1 <- ifelse(data$group == 2, 1, 0)

data$dummy.2 <- ifelse(data$group == 3, 1, 0)

# b coefficients

b.cov = fit$coefficients["covar"]; b.int = fit$coefficients["(Intercept)"]

b.2 = fit$coefficients["factor(group)2"]; b.3 = fit$coefficients["factor(group)3"]

# Adjustment factor for the means of the independent variable

data$mean.adj <- with(data, b.int + b.cov * mean(covar) + b.2 * dummy.1 + b.3 * dummy.2)

aggregate(mean.adj ~ group, data, mean) group mean.adj

1 1 39.18576

2 2 41.95576

3 3 43.36576Real \(\beta\)’s

b.0 = 15 # initial value for group 1

b.1 = 3 # difference between group 1 and 2

b.2 = 4 # difference between group 1 and 3

b.3 = 3 # Weight for covariate

cbind(m.covar = mu.covar*3,

BETA = c(b.0, b.0+b.1, b.0+b.2),

sum = mu.covar*3 + c(b.0, b.0+b.1, b.0+b.2)) m.covar BETA sum

[1,] 24 15 39

[2,] 24 18 42

[3,] 24 19 43